Unlocking ASEAN’s Cross-Border Potential: Stablecoins as the Catalyst for Digital Finance Acceleration

Overview

ASEAN is entering a new phase of digital financial integration, marked by rapid demographic growth, a thriving digital economy, and expanding cross-border commerce. In this evolving landscape, stablecoins, privately issued digital assets designed to maintain stable value, have emerged as powerful enablers of faster, more affordable, and more transparent financial flows. They are not fiat money and not central bank digital currencies (CBDCs); instead, they serve as market-driven instruments that blend blockchain efficiency with the stability of traditional reference currencies.

Regional adoption is accelerating but remains diverse. Singapore has established one of the world’s most comprehensive stablecoin regulatory frameworks, the Philippines is experiencing strong grassroots and institutional momentum driven by remittances and digital commerce, and Indonesia continues to experiment through regulatory sandboxes while assessing systemic implications. These dynamics reflect the region’s appetite for innovation paired with a prudent regulatory approach.

This showcase integrates ASEAN-wide insights with an in-depth interview with Asih Karnengsih (2025), Executive Director of the Blockchain Indonesia Association (ABI). It incorporates typologies from the Cambridge Centre for Alternative Finance’s Digital Money Database. As ASEAN advances digital integration initiatives, such as cross-border QR code interoperability, DEFA stablecoins stand out as a timely and impactful tool for strengthening regional connectivity and enabling more inclusive economic participation.

Understanding Stablecoins: Definition, Boundaries & Misconceptions

Despite their growing prominence, stablecoins remain widely misunderstood. As Karnengsih (2025) highlights, many still conflate stablecoins with fiat money, e-money, or CBDCs, a misconception that blurs critical distinctions. Stablecoins are not sovereign money or government-issued digital currency. Instead, they are privately issued assets, typically backed by reserves, and designed to maintain stable value (Cambridge Centre for Alternative Finance, 2023).

This distinction matters. Unlike CBDCs, which carry a direct claim on central banks, stablecoins derive their reliability from transparent reserve management and issuer governance. They do not replace national currencies; instead, they serve as tools that facilitate efficient settlement and access to global liquidity. This role explains why several ASEAN authorities prefer placing stablecoin experimentation within regulatory sandboxes (CNBC Indonesia, 2025), allowing controlled innovation without granting the asset class legal tender status.

Stablecoins also address a practical market need. In economies where fiat currencies are volatile or monetary aggregates are inconsistent, users often adopt USD-denominated stablecoins as a buffer against uncertainty (Karnengsih, 2025). This is not about undermining monetary sovereignty but about meeting real-world transactional demand, especially for remittances, trade, and digital asset on-ramps that benefit from predictable denominations (IMF, 2024). By clarifying what stablecoins are and what they are not, ASEAN policymakers can regulate them appropriately without stifling innovation.

Market Momentum and the Rise of Stablecoin Demand in ASEAN

Demand for stablecoins in ASEAN continues to rise, driven by structural forces shaping the region’s financial landscape: high remittance volumes, fragmented payment infrastructure, and the rapid growth of digital asset markets (International Monetary Fund, 2024). Migrant workers, numbering more than 35 million across ASEAN corridors, often encounter high fees and slow transfer times. Stablecoins offer a compelling alternative, enabling near-instant, low-cost transactions.

Grassroots adoption is robust in the Philippines, which has emerged as an unexpected leader in Asia in crypto and stablecoins (Disruption Banking, 2025). Retail users turn to stablecoins for remittances and digital commerce, while banks are developing multi-issuer stablecoin models such as PHPx to support broader adoption (Ledger Insights, 2025). This fusion of institutional and user-driven momentum positions the Philippines as a regional pioneer.

Institutional use cases are expanding as well. Fintechs and banks across Vietnam, Malaysia, and Singapore are experimenting with settlement tokens, liquidity instruments, Islamic digital finance applications (CoinMarketCap Academy, 2024), and trade-finance integrations. Despite this momentum, adoption patterns remain uneven. Indonesia maintains cautious oversight, limiting stablecoins to digital-asset classifications while allowing experimentation through supervised sandbox participation (CNBC Indonesia, 2025). However, with more than 17 million crypto users, the market potential is enormous.

Special In-Depth Interview: Insights from Asih Karnengsih, Executive Director of ABI

In a comprehensive interview for this showcase, Asih Karnengsih (2025) offered nuanced perspectives on stablecoins from an ASEAN-wide perspective, while recognising Indonesia’s role within the broader ecosystem. She emphasised that stablecoin users differ significantly from typical crypto investors. In many ASEAN countries, users adopt stablecoins not for speculation, but because local fiat currencies can fluctuate in value or experience instability in monetary aggregates such as M0 and M1. Stablecoins, particularly USD-pegged varieties, offer consistent value that supports cross-border activity and reduces uncertainty.

Karnengsih reiterated that stablecoins must not be mistaken for fiat money or CBDCs. Cryptocurrencies fluctuate with market sentiment, while CBDCs, such as those under Indonesia’s Project Garuda or Singapore’s tokenised deposit pilots (Reuters, 2025), are sovereign instruments. Stablecoins, by contrast, sit firmly in the private sector, governed by issuer reserves, collateral structures, and operational transparency. This market-driven nature explains their rapid rise in global and regional adoption.

When discussing regulation, Karnengsih highlighted Indonesia’s regulatory sandbox, which allows stablecoin innovators to test products under controlled conditions without granting them legal tender status. She noted that several ASEAN countries are adopting similar models, but regional alignment remains inconsistent, a challenge for cross-border transactions. Even so, ASEAN is gradually building a more harmonised understanding of stablecoin typologies, aided by reference frameworks such as the Cambridge Digital Money Database (Appendix 1) (Cambridge Centre for Alternative Finance, 2025).

ASEAN’s Cross-Border Financial Dynamics: Opportunities and Tensions

ASEAN’s cross-border corridors are among the busiest and most complex in the world. The region’s high volume of labour mobility, intra-regional trade, and emerging digital commerce creates significant demand for efficient settlement systems. However, traditional payment rails remain fragmented, often involving multiple intermediaries and high compliance costs.

Stablecoins offer a pathway to reduce settlement friction by providing a universally accessible, stable-value digital unit (AMRO, 2024). They minimise currency slippage in multi-market operations, enhance liquidity for digital merchants, and provide SMEs with new avenues for international commerce. Migrant workers can dramatically reduce remittance fees and settlement times (IMF, 2024).

However, the cross-border nature of stablecoins introduces regulatory complexity. Their private-sector issuance and decentralised networks raise jurisdictional questions: who regulates the issuer, who oversees transactions, and who manages systemic risk during a stress event? Meanwhile, multi-CBDC projects such as BIS’s Project mBridge offer promising public-sector pathways but primarily target wholesale flows (Bank for International Settlements, 2023). Stablecoins and CBDCs, therefore, serve complementary roles in ASEAN’s evolving financial architecture.

Stablecoins as Catalysts for Cross-Border Finance & Digital Trade

ASEAN’s cross-border financial corridors remain among the most expensive and operationally fragmented globally (International Monetary Fund, 2024). Stablecoins have the potential to reshape this landscape by enabling near-instant settlements, lowering transaction fees, and streamlining liquidity for regional businesses.

In the digital economy, stablecoins offer predictable denominators that reduce currency conversion risks, making them especially useful for platforms operating across multiple ASEAN markets. SMEs, which account for 97% of the region’s enterprises, stand to benefit significantly from stablecoin-enabled access to cross-border e-commerce and supply chains.

While CBDC initiatives such as Project mBridge showcase promising intergovernmental collaboration (Bank for International Settlements, 2023), they focus primarily on institutional flows. Stablecoins fill complementary gaps, especially in retail finance, fintech-driven corridors, and digital marketplaces, where private-sector agility is essential.

The Role of Private Sector Innovation and Market Demand

Stablecoins in ASEAN are primarily propelled by private-sector momentum. Fintech startups, established exchanges, and regulated banks are developing innovations ranging from local-currency-backed stablecoins to multi-issuer settlement tokens (Ledger Insights, 2025) and digital Islamic finance instruments (CoinMarketCap Academy, 2024). In markets such as Singapore and the Philippines, institutions are piloting interoperable stablecoin systems designed for both domestic and cross-border use (Disruption Banking, 2025).

Still, innovation must be paired with safeguards. Regulatory priorities increasingly emphasise transparency of reserves, issuer licensing, redemption rights, and alignment of cross-border compliance. Frameworks such as MAS’s stablecoin regulations provide regional guidance on these matters (Monetary Authority of Singapore, 2023). Ultimately, the trajectory of ASEAN’s stablecoin ecosystem will depend on achieving a balance between innovation, consumer protection, and financial stability.

Toward an ASEAN Stablecoin Corridor

As ASEAN progresses toward deeper economic integration through DEFA and cross-border payment linkages, the concept of an ASEAN stablecoin corridor becomes increasingly viable. Such a corridor could enable faster and cheaper regional settlements, complement multi-CBDC platforms, and enhance digital trade across the region’s interconnected economies (AMRO, 2024).

Achieving this vision requires progress on shared terminology, harmonised typology, regional licensing pathways, QR payment interoperability (ASEAN Secretariat, 2023), AML/CFT alignment, and a multi-country regulatory sandbox for cross-border pilots. These priorities align with broader ASEAN cooperation efforts and insights from tokenised settlement research. An ASEAN stablecoin corridor could serve as a backbone for regional digital finance, strengthening resilience, supporting SMEs, and enabling more inclusive economic participation across Southeast Asia.

References

AMRO. (2024). Digital assets and tokenized settlement systems in ASEAN+3 economies. ASEAN+3 Macroeconomic Research Office.

ASEAN Secretariat. (2023). Progress update on ASEAN cross-border QR payment interoperability.

Bank for International Settlements. (2023). Project mBridge: Experimenting with a multi-CBDC platform for international payments. BIS Innovation Hub.

Cambridge Centre for Alternative Finance. (2025). Digital Money Database – Geography Explorer. https://ccaf.io/cdmd/geography

European Central Bank. (2022). The role of stablecoins for monetary policy and financial stability.

International Monetary Fund. (2024). Remittance markets and financial inclusion in Asia.

Karnengsih, A. (2025). In-depth interview on ASEAN stablecoin dynamics.

Ledger Insights. (2025, November). Filipino banks plan to launch multi-issuer stablecoin PHPx on Hedera DLT. https://www.ledgerinsights.com/filipino-banks-plan-to-launch-multi-issuer-stablecoin-phpx-on-hedera-dlt/

MAS (Monetary Authority of Singapore). (2023). MAS introduces regulatory framework for stablecoins.

OJK & CNBC Indonesia. (2025, October 31). BI mau rilis stablecoin versi RI, OJK bilang begini. https://www.cnbcindonesia.com/market/20251031175830-17-681223

Reuters. (2025, November 13). Singapore to trial tokenised bills, bring stablecoin laws, central bank chief says. https://www.reuters.com/world/asia-pacific/singapore-trial-tokenised-bills-bring-stablecoin-laws-central-bank-chief-says-2025-11-13/

Disruption Banking. (2025, November 11). How the Philippines became Asia’s crypto giant.https://www.disruptionbanking.com/2025/11/11/how-the-philippines-became-asias-crypto-giant/

CoinMarketCap Academy. (2024). Malaysia approves first Islamic digital bank using stablecoins. https://coinmarketcap.com/academy/id/article/malaysia-approves-first-islamic-digital-bank-using-stablecoins

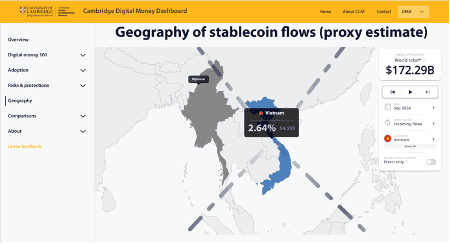

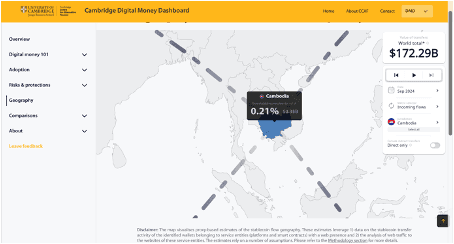

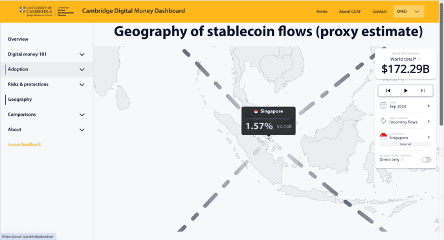

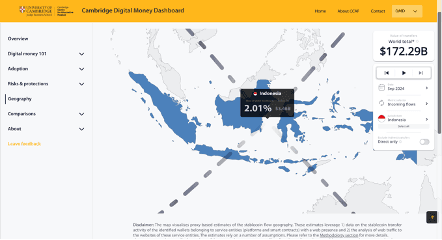

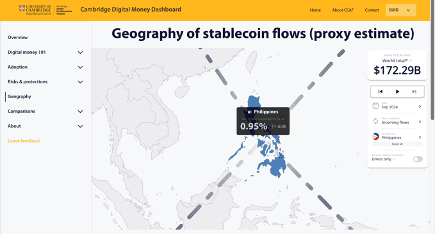

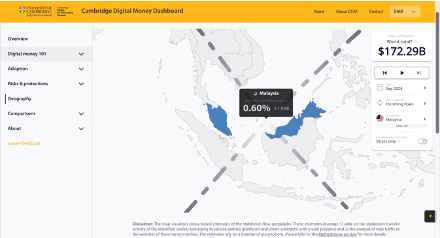

Appendix 1. Geography of Stablecoin Flows

(Proxy- sample countries)

Source: https://ccaf.io/cdmd/geography