ASEAN’s Next Trade Breakthrough: Accelerating Cross-Border Growth Through Interoperable Identity

Overview

Across Southeast Asia, the movement of goods, services, and data is accelerating in ways that were unthinkable a decade ago. Merchants now sell across borders within hours, logistics networks are digitising end-to-end, and financial flows are moving at unprecedented speed. However, every transaction still hinges on one essential issue: whether a business is trusted, verified, and recognised across the region. This surge in digital activity reflects ASEAN’s broader transformation, as e-commerce, digital payments, and data-driven services power an economy projected to exceed USD 2 trillion by 2030. Regional momentum is clear from Indonesia’s rapidly expanding e-commerce sector and Singapore’s scalable digital banks to Thailand’s digital trade documentation, Malaysia’s cross-border fintech services, and the Philippines’ growing digital service exports, while Cambodia, Lao PDR, Myanmar, and Brunei Darussalam seek more seamless pathways into this evolving digital market.

Against this backdrop, a shared opportunity is emerging: ASEAN’s digital economy can grow faster and more efficiently with a unified approach to business identity. The Unique Business Identification Number (UBIN) provides this foundation as a regionally comparable, mutually recognised digital identity that reduces friction, enhances transparency, and accelerates cross-border transactions. Embedded within the ASEAN Digital Economy Framework Agreement (DEFA), UBIN creates the trusted verification layer needed to support paperless trade, digital finance, and interoperable data flows. For enterprises and investors navigating multiple markets, UBIN serves as a strategic catalyst, enabling smoother onboarding, stronger compliance, and a more integrated, secure, and competitive ASEAN digital economy.

Intra-ASEAN Trade: Momentum and Structural Friction

Intra-ASEAN trade has expanded steadily over the past decade as supply chains deepen, digital commerce accelerates, and cross-border logistics become more interconnected. Yet despite this progress, intra-regional trade remains at roughly a quarter of ASEAN’s total trade, far below levels seen in more integrated economic blocs. This gap is driven in part by persistent structural frictions: varying national regulations, fragmented business registries, and inconsistent identity verification practices that introduce cost and complexity into otherwise fast-moving trade flows. For manufacturers shipping components across multiple markets, for MSMEs selling online regionally, and for service providers entering new jurisdictions, these frictions accumulate and slow the pace of regional integration.

As digital trade grows, the effects of these identity-related barriers become even more pronounced. E-commerce platforms, banks, logistics operators, and exporters increasingly depend on real-time, cross-border verification to maintain trust and ensure compliance. Yet businesses still face repeated identity checks, incompatible data structures, and mismatched registry information across Member States. This widening mismatch between rapid digital transactions and slow, inconsistent verification underscores a critical need: a unified, interoperable identity system that allows a business validated in one ASEAN country to be seamlessly recognised across all ten. It is precisely this need that UBIN is designed to address.

“UBIN”: ASEAN’s Smart Digital Identity for Cross-Border Trade Growth

The Unique Business Identification Number (UBIN) serves as ASEAN’s smart, regionally standardized digital business identity, an essential foundation for accelerating cross-border trade and unlocking deeper economic integration. Rather than replacing national registration numbers, UBIN acts as a unifying identity layer that links the region’s diverse business registries through shared data standards, secure API-based verification, and regionally governed trust mechanisms. This enables a business verified in one Member State to be instantly recognized across all ASEAN markets, reducing administrative friction and strengthening the ease of doing business across borders (ASEAN, 2025).

Functionally, UBIN provides enterprises with a secure and consolidated “digital passport” for regional commerce. It empowers financial institutions, customs authorities, logistics providers, e-commerce platforms, and regulators to validate business entities in real time, thereby enhancing speed, reducing compliance costs, and improving the reliability of cross-border operations. For SMEs, which form the backbone of ASEAN’s economic activity, UBIN dramatically simplifies regional expansion by eliminating repetitive onboarding cycles and shortening time-to-market, thereby enabling more inclusive participation in the region’s fast-growing digital trade ecosystem (Antara News, 2024).

UBIN’s architecture is built on five strategic principles designed to ensure long-term impact and equitable economic gains. The Sovereign and Inclusive principle preserves national authority while enabling mutual recognition across borders. Secure and Resilient ensures an open, scalable, and cybersecure digital infrastructure that supports UBIN. Interoperability promotes harmonized standards and seamless API-based data exchange across Member States. Lean, Practical, and Non-Intrusive ensures that UBIN enhances existing national systems rather than burdens them. Finally, MSME Trade-Focused ensures that the benefits of faster onboarding and broader market access extend across all 10 ASEAN Member States. Together, these principles position UBIN as a powerful enabler of the region’s next trade breakthrough and a catalyst for ASEAN’s broader digital transformation.

Policy Progress on UBIN Implementation

By 2025, UBIN will have moved into the implementation preparation stage, supported by political commitment and technical progress across Member States. Most ASEAN countries are now aligning national registries with regional data standards, modernizing digital signature frameworks, and upgrading cybersecurity and privacy legislation to prepare for cross-border identity exchange (ASEAN, 2025).

ASEAN has identified two initial UBIN use cases: Company Search and Business Data as a Service (BDaaS), to operationalize early adoption. These foundational use cases support future applications such as digital customs, eKYC for cross-border finance, trade documentation, and e-procurement. Private-sector consultations indicate strong demand for UBIN-enabled identity systems from e-commerce platforms, banks, and logistics providers that routinely face cross-border verification challenges (Bernama, 2025a). Malaysia has reinforced its commitment to DEFA implementation, noting that a fully integrated ASEAN digital market could unlock up to USD 2 trillion in additional digital value by 2030 (Bernama, 2025b). UBIN is therefore positioned as an essential infrastructure pillar that deepens ASEAN’s economic integration and strengthens the region’s competitiveness.

How UBIN Supports the ASEAN Digital Economy Framework Agreement (DEFA)

DEFA aims to establish a unified ASEAN digital economy with interoperable systems supporting data flows, digital payments, cybersecurity, paperless trade, and digital identity. UBIN directly supports DEFA by providing a trusted business identity framework that underpins nearly all digital trade activities. Without a regionally recognized identity mechanism, DEFA’s ambitions for seamless cross-border digital transactions would remain difficult to implement effectively (ASEAN, 2025).

Key DEFA components, such as e-invoicing, electronic certificates of origin, digital customs processing, and digital finance, require real-time, authenticated business identity verification. UBIN provides this trust layer, enabling businesses to participate in regional digital trade securely and efficiently. UBIN also strengthens SME inclusion, a central DEFA objective, by reducing the complexity and cost of entering new ASEAN markets (Cambodianess, 2024).

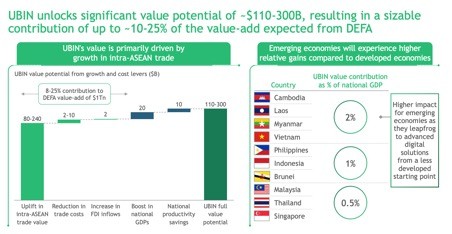

In Appendix 1, we see that ASEAN’s economic analysis estimates that UBIN could unlock USD 110–300 billion in value, contributing 10–25 percent to DEFA’s projected USD 1 trillion uplift in the digital economy (ASEAN, 2025). This value is generated through several quantifiable channels, including USD 80–240 billion in increased intra-ASEAN trade driven by more seamless market entry and cross-border onboarding. Additionally, UBIN is expected to reduce trade friction costs by USD 2–10 billion, streamline verification processes, and lower compliance overhead for exporters and digital platforms. Foreign direct investment could rise by approximately USD 2 billion, reflecting enhanced transparency and investor confidence in regional business data. UBIN also supports broader macroeconomic gains, including an estimated USD 20 billion increase in collective GDP and roughly USD 10 billion in productivity improvements tied to faster verification, reduced documentation errors, and improved supply-chain efficiency across ASEAN Member States.

Business and Investment Opportunity Showcase Across ASEAN

ASEAN’s digital economy is entering a period of accelerated expansion, creating one of the most compelling investment environments among emerging global regions. Digital GMV across Southeast Asia is forecast to exceed USD 300 billion by 2025, a 7.4-fold increase from 2016 (Google, Temasek, & Bain, 2025). Long-term projections estimate that ASEAN’s total digital economy could surpass USD 2 trillion by 2030, driven by rising connectivity, youthful demographics, and strong intra-regional economic integration (ASEAN, 2025). However, across sectors from e-commerce and fintech to logistics and manufacturing, businesses confront verification frictions that limit scale and slow expansion. UBIN emerges as a transformative enabler, unlocking synchronized regional growth.

In the e-commerce and digital retail sectors, ASEAN’s 460+ million internet users represent significant commercial potential. Indonesia alone contributes nearly USD 60 billion in annual e-commerce GMV, accounting for almost 40% of regional value (Antara News, 2024). Vietnam, Malaysia, and the Philippines are also experiencing rapid market expansion. As merchants increasingly sell across borders into Singapore, Thailand, and Brunei Darussalam, repeated identity checks slow onboarding and increase platform operating costs. UBIN’s single trusted identity can reduce onboarding time by days or weeks, accelerating GMV activation and enabling inclusive participation for sellers in Cambodia, Lao PDR, and Myanmar.

In financial services and fintech, ASEAN is one of the world’s fastest-growing digital finance markets, with over 310 million active e-wallet users and expanding digital lending ecosystems (Asia Lifestyle Magazine, 2025). Singapore, Indonesia, and Malaysia lead fintech innovation, while Vietnam and the Philippines drive consumer adoption. However, inconsistent identity rules raise compliance costs for AML/KYC and delay regional financial flows. UBIN’s interoperable identity layer enhances trust, reduces operational risk, and enables cross-border credit verification, strengthening investment returns across multi-market fintech portfolios.

The logistics, transport, and supply chain sector is essential to ASEAN’s rise as a global manufacturing hub. Thailand and Vietnam dominate automotive and electronics exports; Malaysia strengthens its semiconductor capabilities; Indonesia expands industrial capacity; and the Philippines accelerates services-led logistics. Cross-border shipments often face delays due to mismatched identity documentation. UBIN enables verification once, trusted everywhere, supporting customs interoperability and boosting cargo throughput in key corridors such as Thailand–Vietnam, Indonesia–Malaysia–Singapore, and the wider Mekong region.

ASEAN’s manufacturing and industrial export sectors present significant opportunities for investors seeking supply chain diversification. Vietnam, Malaysia, and Thailand deliver substantial output in electronics and automotive components, while Indonesia advances in minerals and battery production. Supplier onboarding and procurement require multi-layered identity checks. UBIN standardizes identity assurance, reducing fraud risk, shortening contracting cycles, and strengthening governance, improving investment confidence in industrial clusters across ASEAN.

The digital services and knowledge economy anchored by Singapore, the Philippines, Vietnam, and Indonesia is scaling across borders. Filipino BPO firms, Indonesian creative studios, Singaporean fintech architects, and Vietnamese IT developers increasingly serve ASEAN clients. Fragmented identity requirements slow contracting and reduce operational efficiency. UBIN simplifies cross-border onboarding, boosting productivity and enhancing revenue scalability, valuable advantages for venture-backed and corporate-backed digital firms.

In agriculture, food systems, and rural commerce, UBIN expands market access for smaller producers across Lao PDR, Cambodia, Myanmar, and rural Indonesia. Without a trusted identity, these SMEs face limited visibility and slow approvals on digital platforms across Thailand, Vietnam, Malaysia, and Singapore. UBIN enables direct participation in regional value chains, creating new investment opportunities in agritech, digital traceability, and rural logistics.

From an investment and corporate governance standpoint, UBIN reduces information asymmetry, one of the most significant risks for investors evaluating SMEs across ASEAN. Fragmented national registries complicate due diligence. UBIN provides regionally comparable, authenticated business identity data that increases transparency and accelerates deal flow. This strengthens venture capital, private equity, and institutional investment across ASEAN’s top startup ecosystems: Indonesia, Vietnam, Singapore, Malaysia, Thailand, and the Philippines.

Finally, UBIN supports major regional integration initiatives, such as the Trusted Data Corridors and the Singapore–Johor–Batam (SJB) Special Economic Zone, both of which depend on secure, interoperable identity validation to facilitate data exchange, customs collaboration, and digital trade flows (ASEAN-BAC, 2025). These projects illustrate the scale of opportunity for high-trust digital infrastructure investment across Indonesia, Malaysia, Singapore, and beyond.

Policy Recommendations for Accelerating ASEAN’s Cross-Border Trade Growth

To unlock ASEAN’s next major leap in cross-border trade, UBIN’s implementation must be positioned not merely as a technical reform, but as a strategic growth accelerator for the region’s digital economy. While the foundations are strong, ASEAN can amplify UBIN’s impact by addressing several practical considerations with a forward-looking, opportunity-driven approach. The first opportunity lies in ASEAN’s diverse digital landscape. Countries such as Singapore, Malaysia, and Indonesia possess advanced digital registries that can serve as early connectors in a tiered, fast-track integration model. At the same time, Cambodia, Lao PDR, and Myanmar can benefit from coordinated capacity-building and shared investments in digital infrastructure. This approach ensures that regional interoperability advances rapidly without leaving emerging economies behind.

A second opportunity is the modernization and alignment of national business registries. Today’s variations in data structures, verification rules, and update cycles create unnecessary friction in sectors such as e-commerce, financial services, and logistics. By adopting regionally consistent minimum data standards, Member States can dramatically accelerate cross-border onboarding and create a more reliable foundation for digital trade. This harmonization does not replace national systems; instead, it elevates them to support a more competitive ASEAN marketplace.

A third opportunity lies in strengthening regulatory coherence. Differences in digital signatures, licensing requirements, and data protection laws often lead to redundant KYC processes for businesses expanding across borders, affecting digital service exporters in the Philippines, marketplace sellers in Indonesia, and manufacturers in Thailand and Vietnam. ASEAN can accelerate interoperability by developing a mutually recognized regional trust framework that enables documents, signatures, and digital identities validated in one Member State to be accepted across the region with confidence.

A fourth opportunity centers on scaling private-sector readiness. SMEs, which represent more than 97 percent of businesses in ASEAN, often lack the tools to participate in API-based digital verification ecosystems. ASEAN can close this gap by launching UBIN-ready SME toolkits, co-developed with industry partners, and by incentivizing large platforms, e-commerce, fintech, logistics, and supply-chain operators to integrate UBIN in early cross-border pilots. Indonesia’s e-commerce sector, Singapore’s financial hubs, Malaysia’s fintech ecosystem, Vietnam’s digital exporters, and Thailand’s logistics networks are well-positioned to drive high-impact pilot deployments.

A fifth opportunity is to strengthen governance structures that ensure UBIN’s long-term reliability. Establishing national UBIN authorities in every Member State will reinforce accountability, ensure the accuracy of business data, and support seamless coordination with the ASEAN Secretariat. Brunei Darussalam’s advanced digital identity architecture can serve as a benchmark for governance excellence that other Member States can adopt or adapt.

Finally, ASEAN’s trade breakthrough will depend on deeper public–private collaboration. Banks, marketplaces, logistics providers, and cross-border payment companies process millions of identity checks each year and are therefore essential partners in validating and operationalizing UBIN at scale. ASEAN should establish UBIN Industry Councils and cross-border regulatory sandboxes to test real-world workflows, validate system performance, and accelerate commercialization across high-volume sectors.

Through these strategic actions, ASEAN can turn UBIN from a promising policy initiative into a high-impact digital infrastructure that drives regional competitiveness, enhances investor confidence, and accelerates the flow of goods, services, and capital across all ten Member States.

Conclusion

The next phase of ASEAN’s trade advancement is taking shape, grounded in the establishment of trusted digital identity. UBIN provides a regionally recognised business identity framework that reduces administrative friction, facilitates cross-border operations, and enables organisations to engage with greater certainty across all ten Member States. Embedded within DEFA, UBIN offers the interoperability and trust architecture necessary for ASEAN to function as an integrated digital market, supporting more efficient onboarding processes, consistent regulatory compliance, and secure data exchange.

Across Southeast Asia, from Indonesia to Brunei Darussalam, and from Cambodia to Singapore, business growth increasingly depends on seamless and reliable verification. In this context, UBIN emerges as a critical enabler of investment, integration, and competitiveness. It reinforces digital trust, unlocks new channels of capital flow, and enhances the efficiency of goods, services, and financial transactions across borders. By establishing this high-assurance, high-efficiency environment, UBIN positions ASEAN to achieve its next major trade breakthrough and advance toward becoming one of the world’s most dynamic and competitive digital trading blocs.

References

Antara News. (2024). Unlocking ASEAN’s digital trade with digital business identity. https://en.antaranews.com/news/394605/unlocking-aseans-digital-trade-with-digital-business-identity

ASEAN. (2025). Public Summary of Implementation Roadmap to Establish Regionally Comparable and Recognised UBIN in ASEAN. https://asean.org/wp-content/uploads/2025/04/Public-Summary-of-Implementation-Roadmap-to-Establish-Regionally-Comparable-and-Recognised-UBIN-in-ASEAN-1.pdf

ASEAN Business Advisory Council. (2025). Trusted data corridors and the SJB SEZ model: ASEAN’s blueprint for cross-border digital integration. https://asean-bac.org/news-and-press-releases/trusted-data-corridors-and-the-sjb-sez-model-asean-s-blueprint-for-cross-border-digital-integration

Bernama. (2025). ASEAN prepares for digital economy integration under DEFA. https://asean.bernama.com/news.php?id=2497863

Cambodianess. (2024). Unlocking ASEAN’s digital trade with digital business identity. https://cambodianess.com/article/unlocking-aseans-digital-trade-with-digital-business-identity

Cambodianess. (2025). Cambodia's e-commerce boom set to top $1.78B by 2025. https://cambodianess.com/article/cambodias-e-commerce-boom-set-to-top-178b-by-2025

Google, Temasek, & Bain & Company. (2025). e-Conomy SEA 2025 report: ASEAN’s digital economy poised to surpass $300 billion in GMV.

World Economic Forum. (2025). Implementation lessons for ASEAN’s digital economy framework. https://www.weforum.org/stories/2025/04/implementation-lessons-for-asean-s-digital-economy-framework

Appendix

Appendix 1. UBIN’s Projected Economic Value Contribution in ASEAN

Source: ASEAN, 2025.